reverse sales tax calculator ny

Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations. This reverse sales tax calculator will calculate your pre-tax price or amount for you.

Reverse Sales Tax Calculator Calculator Academy

File sales tax returns.

. The following security code is necessary to prevent unauthorized use of this web site. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out. Claim for Refund of Taxes Paid on Government Entity Credit Card Purchases of Fuel.

Sales tax forms and instructions current tax year. Sales tax credits and refunds. Used Vehicles for Sale in Bayside NY.

Or to make things even easier input the NYC minimum combined sales tax rate into the calculator at the top of the page along with the total sale amount to get all the detail you need. New York has a 4 statewide sales tax rate but also has 640 local tax jurisdictions. For taxpayers in the state of New York theres New York City and then theres everywhere else.

All you need is. Sales tax forms and instructions prior years and periods. Amount without sales tax GST rate GST amount.

Enter either the sales tax amount in dollars such as 10 for 10 or the sales tax rate such as 85 for 850. Penalty and Interest Calculator. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

An error margin of 001 may appear in reverse calculator of Canada HST GST and PST sales tax. Sales Tax Web File the e-file mandate requires most taxpayers to Web File PrompTax. Our free online New York sales tax calculator calculates exact sales tax by state county city or ZIP code.

You can also use our Sales Tax Calculator for Reverse Sales Tax calculation to skip the aforementioned manual method. Due to rounding of the amount without sales tax it is possible that the method of reverse calculation charges does not give 001 to close the total of sales tax used in every businesses. Purchase Location ZIP Code -or-.

You will need to input the following. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to New York local counties cities and special taxation districts. Claim for Refund of Taxes Paid on Fuel by a Government Entity.

The average total car sales tax paid in New York state is 7915. For tax years before 2018 you have until October 15th of the year after making a conversion to reverse it and avoid the related tax liability. Reverse Sales Tax Calculations.

Input the 85 Gross Price of Rug as Amount after Tax. Amount without sales tax QST rate QST amount. New York is one of the five states with.

Here is how the total is calculated before sales tax. Input or select 800 of combined Sales Tax Rate on the Tax Rate. Application for Refund of Prepaid Sales Tax on Motor Fuel Sold Other Than at Retail Service Stations.

Price before Tax Total Price with Tax - Sales Tax. Sales tax rates and identifying the correct local taxing jurisdiction. You can use our New York Sales Tax Calculator to look up sales tax rates in New York by address zip code.

Sales tax total amount of sale x sales tax rate in this case 8. Margin of error for HST sales tax. Our calculator will automatically calculate the result and represents it in 3 different forms.

To calculate the amount of sales tax to charge in New York City use this simple formula. Order Now Offer Details. The highest possible tax rate is found in New York City which has a tax rate of 888.

Rather than calculating sales tax from the purchase amount it is easier to reverse the sales tax and separate the sales tax from the total. Reverse Sales Tax Calculator. See screenshots read the latest customer reviews and compare ratings for Reverse Tax Calculator.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. The Mansion Tax in NYC is a progressive buyer closing cost which ranges from 1 to 39 of the purchase price on sales of 1 million or more. Enter the security code displayed below and then select Continue.

Sales tax rates product taxability rules and regulations differ. Sales Tax Rate Sales Tax Percent 100. Multiply the result from step one by the tax rate to get the dollars of tax.

These numbers help explain why sales tax compliance is so complicated.

Kentucky Sales Tax Calculator Reverse Sales Dremployee

New York Sales Tax Calculator Reverse Sales Dremployee

How To Calculate Sales Tax Backwards From Total

The Impact Of Hybrid Work On Commuters And Nyc Sales Tax Office Of The New York City Comptroller Brad Lander

Us Sales Tax Calculator Reverse Sales Dremployee

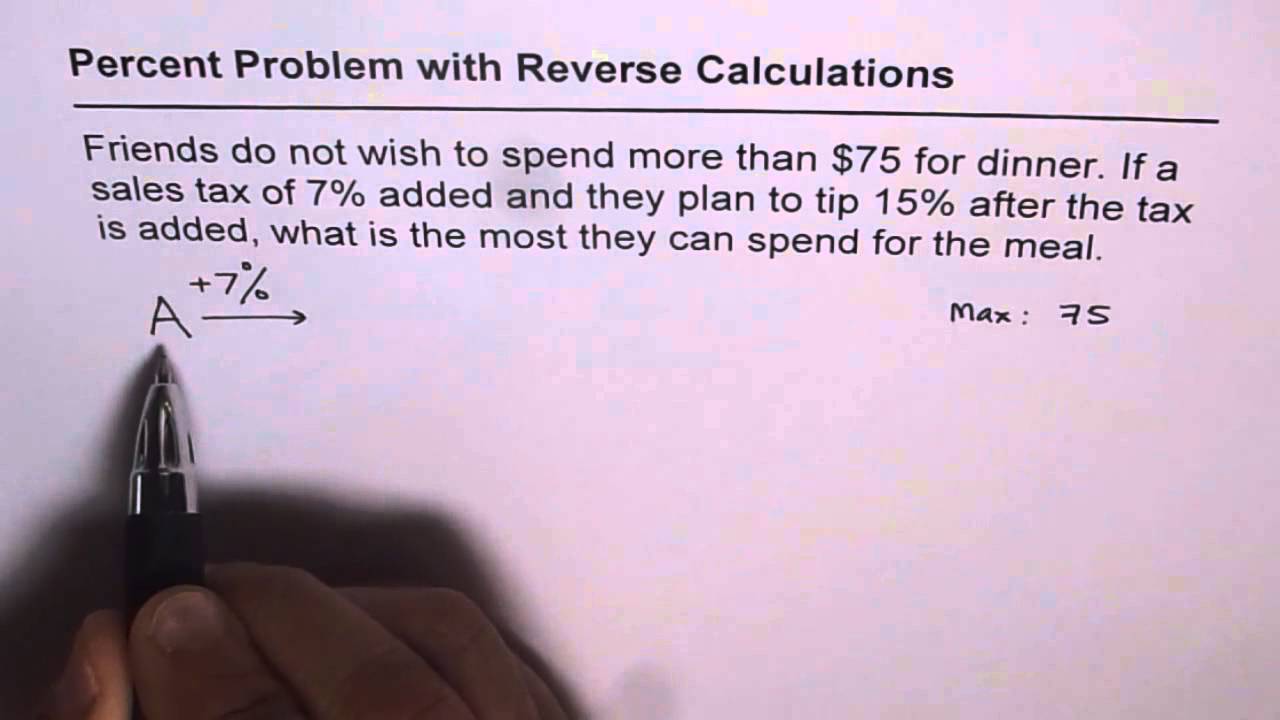

How To Calculate Amount With Percent Tax And Tip With Reverse Calculations Youtube

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

How To Calculate Sales Tax Backwards From Total Reverse Tax Calculator

Reverse Sales Tax Calculator 100 Free Calculators Io

Reverse Sales Tax Calculator Calculator Academy

Tip Sales Tax Calculator Salecalc Com

How To Calculate Sales Tax Backwards From Total

New Development Closing Cost Calculator For Nyc Interactive Hauseit

Reverse Sales Tax Calculator De Calculator Accounting Portal